The YMCA Youth Gambling Awareness Program (YGAP) is a collaboration between the YMCA of Greater Toronto and 18 local YMCAs, consisting of 19 Youth Outreach Workers (YOWs) across Ontario. The program is funded by the Ontario Ministry of Health and Long Term Care. The Youth Gambling Awareness Program (YGAP), run by the YMCA, is a free service, offering educational prevention programs designed to raise youth awareness with regards to gambling, healthy/active living, and making informed decisions. Working with the Ontario Ministry of.

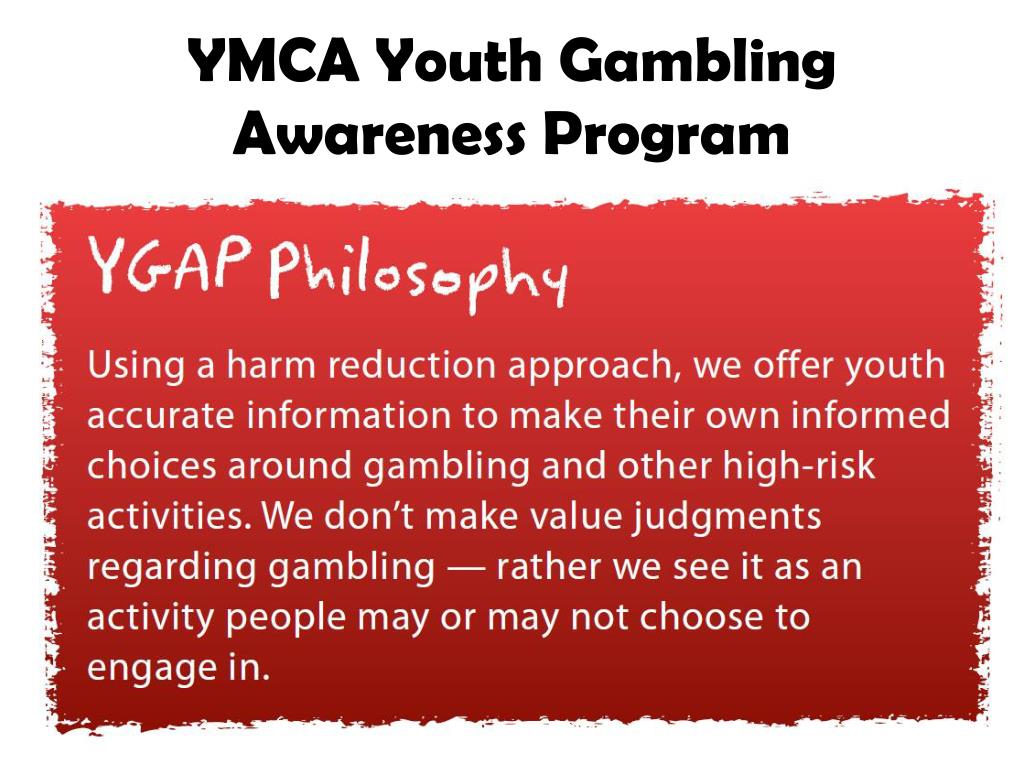

Youth Gambling Awareness Program We believe that prevention programs are essential to improving individual health and personal development and creating a healthier community. The Y implements educational prevention programs designed to raise youth awareness with regards to gambling, healthy/active living and making informed decisions. The YMCA Youth Gambling Awareness Program is a free service offering educational prevention programs designed to raise youth awareness with regards to gambling, healthy/active living and making informed decisions. Our educational prevention programs raise awareness about gambling. The YMCA of Greater Toronto also delivers many youth programs at the provincial and national level including a Youth Gambling Awareness Program and Digital Skills Literacy Program. For further information or to arrange an interview, contact: Brittany Arnold, arnold@veritasinc.com, 905-926-1863 Camille Cote-Begin, cotebegin@veritasinc.com, 416.

Ymca Youth Gambling Awareness Program Training

The Youth Gambling Awareness Program is a funded program though the Ontario Ministry of Health Promotion. This program reaches youth ages 8-24 years of age as well as those who influence and work with youth. This program offers youth information to make informed and healthy decisions about gambling.

Ymca Youth Government Program

What we offer in Guelph, Kitchener-Waterloo and Cambridge |

|

Community Involvement |

| Each year the Youth Gambling Awareness Program plans and implements events designed to promote community awareness and involvement related to youth gambling. |

Youth Engagement |

YGAP supports youth driven initiatives in our community to promote youth expression and community action related to youth gambling. Our Approach:

Recent Research

|

This November, Credit Canada hosted its 12th annual “Credit Education Week” aimed at helping Canadians focus on “Money Mindfulness.” Here at the Youth Gambling Awareness Program (YGAP) we would like to build on that and share information about how Canadian youth, specifically, can begin to achieve their financial goals.

Our program aims to educate youth on safe gambling practices and understanding the value of money is vital to this task. Today’s youth are the first generation to grow up in a culture where gambling is actively promoted. As gambling becomes increasingly more accessible through technology, it’s important to encourage youth to think critically about their money and how they spend it. While this seems like an issue for the “grown ups,” statistics show that millennials are the ones struggling. It is reported that 29% of millennials experience relationship issues due to indulgent money spending and 28% hide their spending from others (Credit Canada 2017). Furthermore, when it comes to gambling, 10% of teens gamble online and 40% gamble in any form, betting on activities like dares or challenges, games of skills, and sports pools (OSDUHS 2015). This year, our youth outreach workers rolled out a variety of educational activities and engagement events across Ontario to support youth in gambling responsibly and making responsible financial decisions.

Over the month of November, YGAP ran 42 of our “Betting $en$e” workshops, which focus on financial literacy and gambling awareness. These presentations took place across the province in locations such as Saul Ste Marie, Simcoe/Muskoka, London, Sarnia, Windsor, and Guelph. These workshops, which are delivered in both French and English, aim to increase awareness of the risks involved in gambling and the importance of making informed decisions about financial issues. Participants are encouraged to explore personal finances, budgeting, spending, borrowing, saving, and gambling harm reduction strategies. Our outreach workers make the experience fun, engaging, and incredibly informative. This year, YGAP collaborated with community partners to offer this programming, with areas like Owen Sound inviting representatives from CAMH, the Owen Sound Police Department, and Telus Wise to present to youth on topics related to financial literacy, gambling, and gaming.

Additionally, YGAP set up booths in YMCA locations, community centres, and schools handing out credit education material. Whether it was the McBain Community Centre in Niagara, the Durham Family YMCA, or Windsor’s Central Park Athletics, our outreach team worked tirelessly to engage youth on the relevance of responsibly gambling to money mindfulness.

Some YGAP locations even ran larger Youth Engagement (YE) and Community Involvement (CI) initiatives. In Kenora, YGAP partnered with Lake of the Woods and Beaver Brae to run a “Money Mindfulness Youth Engagement Photography Project”. Youth were encouraged to take pictures of every day expenses, such as coffee that can add up and make a big financial impact. When thinking about gambling, we encourage youth to decide how even small transactions can affect them.

In Timmins, Peterborough and the Hamilton/Burlington/Brantford area YGAP ran large community involvement financial literacy events. Community members had the opportunity to interact with organizations such as the Royal Bank of Canada, Ontario Works, St. Leonard’s Community Services, and The Family Counselling Centre, in an effort to promote education about how financial literacy is connected to overall wellness.

The final mural from the students at École élémentaire des Quatre-Rivières.

Lastly, in Toronto, youth from École élémentaire des Quatre-Rivières created a mural that represented how financial considerations change and develop from childhood to adulthood and how this can be affected by gambling and gaming. This concept is incredibly relevant to youth given that the average person begins gambling around the age of 8 (Pitt et al 2017). This takes the form of nontraditional gambling activities like risking money at a claw machine, buying raffle tickets at school or betting valuables through online gaming. While the legal age for buying a lottery/scratch ticket in Ontario is 18 and 19 for visiting a casino, youth brains are not considered fully developed until the age of 25. While it is only one part of the brain that is still developing, it is the part of the brain that controls impulses and higher-level thinking (Gogtay et al 2004). Encouraging youth to think about how their current gambling habits may influence their future choices acts as a tool to help youth make responsible financial decisions in the future.

It’s important to remember that at any age, we can all benefit from a little more information about gambling awareness and financial literacy. If you are looking for resources for yourself or for someone you know, head over to the Youth Gambling Awareness or Credit Canada Website.